Strategic

CAPABILITIES

that bridge Alts to Wealth.

Strategic

CAPABILITIES

that bridge Alts to Wealth.

Your Gateway to Growth in Wealth Management.

Breaking into U.S. Wealth Management requires expertise, relationships, and sales execution. AltsXL provides the strategic insight, deep industry relationships, and the national sales footprint to help asset managers aggressively access this market—faster, better, and at lower cost.

Key Highlights

- Deep expertise in Wealth Management leadership.

- Established relationships across key distribution channels.

- A powerful national sales & distribution team that drives measurable results.

- A streamlined, cost-efficient approach to accelerating market penetration.

Tailored Solutions for Scalable Success.

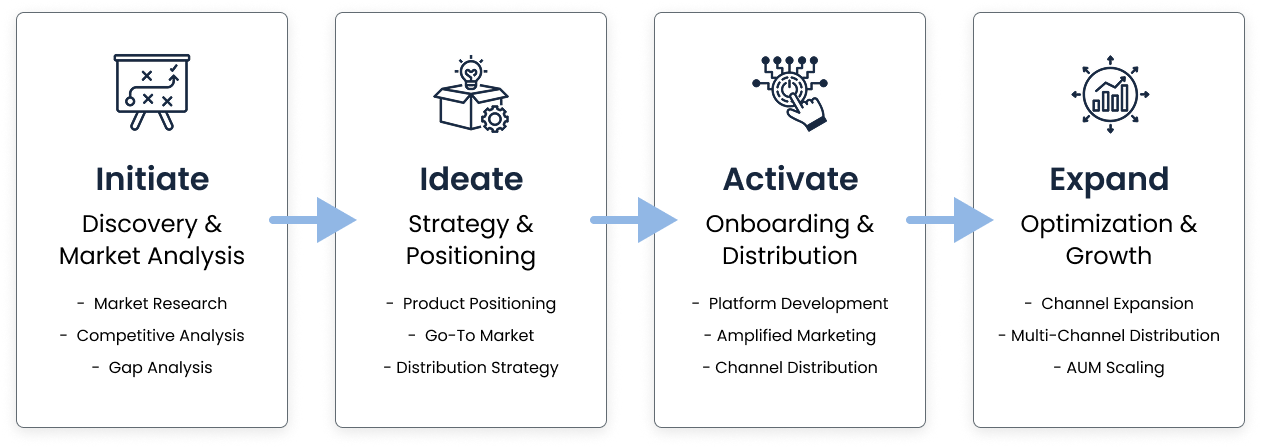

A proven framework for growth and execution.

AltsXL delivers tailored solutions that equip alternative asset managers with the knowledge and resources they need to aggressively scale in U.S. Wealth Management channels. Our sequential, performance-oriented approach ensures the alignment of interests , helping clients capitalize on opportunities for growth and long term success.

Strategic Consulting

- Discovery

- Market analysis

- Gap analysis

- Strategic plan

Product Management

- Product selection

- Origination

- Launch

- Development

Platform Development

- Custodians

- RIAs

- Broker dealers

- Wirehouses

- Private banks

Sales & Distribution

- Strategy & positioning

- Education & training

- Go-to market

- Sales execution

- Event management

- Talent development

Strategic Consulting

- Discovery

- Market analysis

- Gap analysis

- Strategic plan

Product Management

- Product selection

- Origination

- Launch

- Development

Platform Development

- Custodians

- RIAs

- Broker dealers

- Wirehouses

- Private banks

Sales & Distribution

- Strategy & positioning

- Education & training

- Go-to market

- Sales execution

- Event management

- Talent development

Our process is designed to deliver results at every stage of market entry and expansion.

Services: The Core of Our Execution

Comprehensive solutions for market penetration and growth.

AltsXL provides a full suite of services to help alternative asset managers expand within U.S. Wealth Management channels, from initial strategy to ongoing execution.

Strategic Consulting

- Discovery

- Market Analysis

- Gap Analysis

- Strategic Plan

Product Management

- Product Selection

- Origination

- Launch

- Development

Platform Development

- Custodians

- RIAs

- Broker Dealers

- Wirehouses

- Private Banks

Sales & Distribution

- Strategy & Positioning

- Education & Training

- Go-To Market

- Sales Execution

- Event Management

- Talent Development

Strategic Consulting

- Discovery

- Market Analysis

- Gap Analysis

- Strategic Plan

Product Management

- Product Selection

- Origination

- Launch

- Development

Platform Development

- Custodians

- RIAs

- Broker Dealers

- Wirehouses

- Private Banks

Sales & Distribution

- Strategy & Positioning

- Education & Training

- Go-To Market

- Sales Execution

- Event Management

- Talent Development

Strategic Consulting

- Discovery

- Market Analysis

- Gap Analysis

- Strategic Plan

Product Management

- Product Selection

- Origination

- Launch

- Development

Platform Development

- Custodians

- RIAs

- Broker Dealers

- Wirehouses

- Private Banks

Sales & Distribution

- Strategy & Positioning

- Education & Training

- Go-To Market

- Sales Execution

- Event Management

- Talent Development

Strategies & Structures

Providing the right products at the right time to effectively penetrate markets.

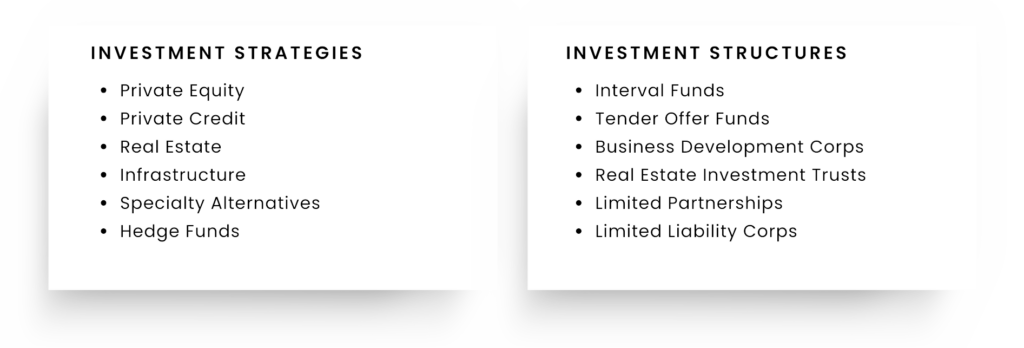

Bringing the right strategy to market in the right product at the right time matters. AltsXL works directly with alternative managers to increase their probability for success in the broader U.S. Wealth Management market. Below are the investment strategies and breadth of structures that AltsXL advises on and distributes.

Investment Strategies

- Privacy Equity

- Private Credit

- Real Estate

- In

Strategic Consulting

- Discovery

- Market Analysis

- Gap Analysis

- Strategic Plan

Investment Strategies

- Private Equity

- Private Credit

- Real Estate

- Infrastructure

- Specialty Alternatives

- Hedge Funds

Investment Structures

- Interval Funds/Tender Offer Funds

- Business Development Corporations (BDCs)

- Real Estate Investment Trusts

- LPs

- LLCs

- Private Placements

Target Markets

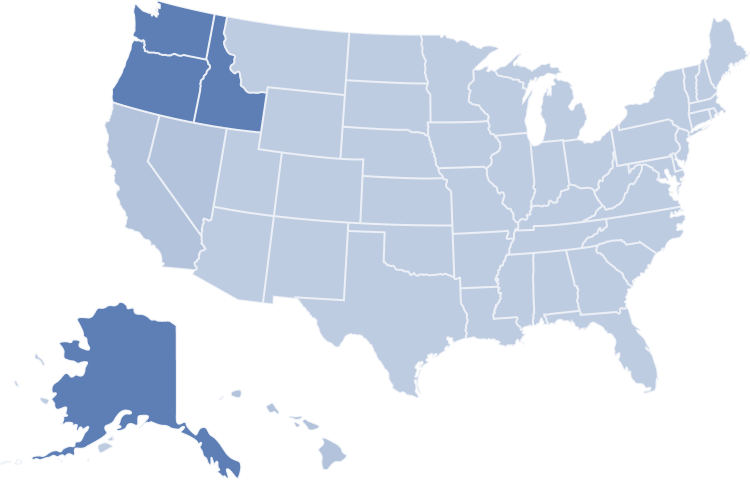

A National Sales Team covering all major U.S. markets across all channels (see map).

AltsXL provides national coverage of the primary U.S. Wealth Management channels across platform development, sales, and distribution. The external sales team members live in their respective markets across 15 territories providing in-person engagement to enhance service and support. As the Advisor community returns to office, having that in-person connectivity is a competitive advantage that we take seriously. We facilitate in-office meetings, out-of-office meetings, continuing education, and client events to help Advisors and their clients allocate to alternatives with confidence.

Custodial Platforms

Custodial platforms are the conduit for RIAs and many Independent Advisors to execute efficiently and effectively in alternative investments. Schwab, Fidelity, and Pershing capture the majority of the custodial relationships, so product availability on these platforms is essential to streamlining the allocation process. AltsXL works with the custodial home offices to create product awareness, facilitate onboarding, and subsequently manage the due diligence process on behalf of our managers.

Registered Investment Advisors (RIAs)

With over 15,000 RIAs in the US distributed across the country, our breadth of coverage ensures cost effective and efficient support of this channel at the local level. We support individual RIAs, RIA Aggregators, and Multi-Family Offices.

Independent Broker Dealers (IBDs)

Focusing on the most significant players in this highly fragmented channel, we target Raymond James, LPL, Ameriprise, Cetera, Osaic, and other larger IBDs to access and penetrate this challenging but lucrative market.

Regional Broker Dealers (RBDs)

Regional Broker Dealers provide unique opportunities as they tend to be very responsive to the needs of their advisors and recognize the importance of differentiation. Our representatives have engaged this channel for decades and understand the nuances of this typically underserved market.

Wirehouses

Wires control the largest share of wealth assets in the U.S. and provide the highest AUM per Advisor outside of private banks, so it is a highly coveted channel. With 65,000 advisors across the country and a rigorous due diligence process, AltsXL helps its clients navigate the challenges of this channel and clear the hurdles necessary to succeed.

Private Banks

HNW and UHNW clients are serviced exclusively in this channel and they are well versed in private markets and alternative investments. It is a highly coveted market and the need for effective representation is critical.

Investment Strategies

- Private equity

- Private credit

- Real estate

- Infrastructure

- Specialty alternatives

- Hedge funds

Wealth Management Distribution Channels

- Custodial platforms

- Registered investment advisors (RIAs)

- RIA aggregators

- Independent broker-dealers (IBDs)

- Regional broker dealers

- Wirehouses & private banks

- Family offices and multi-family offices

Investment Structures

- Interval funds/tender offer funds

- Business development corporations (BDCs)

- Real estate investment trusts

- Partnerships

- LLCs

- SPVs

Coverage Map

Servicing every major market across 17 regions covering all 50 states.

Interact with the map for specific regions and sales manager representatives.

Interact with the map for specific regions and sales manager representatives.

Check back for Coverage Map.

New England

Doug Romano

Northeast

Joe McMenamin

Mid Atlantic North

Sean Maguire

Midwest South

Larry Johns

Mid Atlantic South

Jim Nichols

Southeast

Jason Jackson

Florida

John Sermania

Great Lakes

Eric Tesler

Midwest North

Rob Rodgers

Central Plains

Rob Rodgers

South

Carla Goehring

Texas/Oklahoma

Ken Ward

Mountain States

Kevin Campbell

Pacific Northwest

Ken Rosenson

N Cal/Nevada & Pac NW

Ron Lynch

Southern California

Ken Rosenson

Los Angeles/Hawaii